Metro DC Housing Market Analysis: 2011 07

Posted: August 9, 2011 Filed under: Metro DC Housing Analysis | Tags: 2011, Alexandria, Arlington County, Average Close Price, days on market, Fairfax, Foreclosures, Housing, Loudoun, Market Trends, Median Sales Price, Montgomery County, NVAR, Prince George's County, Prince William County, Recovery, Sales, Short Sales, Washington Leave a commentPrince George’s County Continues to Struggle

August 9, 2011

(Washington, DC) – Prince George’s County is one of the components of the Metropolitan Washington, DC region (which also includes Montgomery County in Maryland, Arlington, Fairfax, Loudoun, and Prince William counties in Virginia and the cities of Alexandria, Falls Church, Fairfax, Manassas and Manassas Park in Virginia and Washington, DC). Since 2006, Prince George’s has generated 14 percent of the region’s total existing home sales volume. Even though it has always been known as an affordable alternative to the more costly DC suburbs, Prince George’s County is an anomaly in this region; its housing market is in a steep and steady decline.

Consider the fact that the entire metro DC region has suffered a 21 percent decline in its year-to-date median sales price (January through July each year) since 2006. Bad enough, to be sure, but the comparable decline in Prince George’s County is a whopping 50 percent and still falling. While the year-to-date median sales price has seen modest increases throughout the metro area in 2010 and 2011, Prince George’s County has had six consecutive years of median price decreases.

-

Metro DC Jan-Jul 2006 MSP = $415,000; Metro DC Jan-Jul 2011 MSP = $330,000

-

PGC Jan-Jul 2006 MSP = $320,000; PGC Jan-Jul 2011 MSP = $160,000

So far this year, the median sales price in Prince George’s County has declined 7 percent whereas the median has increased 18 percent for the entire region and while the metro area had three decreases in the last seven months, Prince George’s has had five.

-

Metro DC Jan 2011 MSP = $299,900; Jul 2011 = $355,000

-

PGC Jan 2011 MSP = $171,900; Jul 2011 = $160,000

Compare the July average days on market in the metro DC area of 64 days to the comparable average in Prince George’s County – 104 days. The average across the region declined 19 percent from January to July 2011 while it increased 17 percent in Prince George’s County.

-

Metro DC Avg Days on Market Jan 2011 = 79 days; Jul 2011 = 64 days

-

PGC Avg Days on Market Jan 2011 = 89 days; July 2011 = 104 days

-

Metro DC YTD Avg Days on Market 2011 = 72 days

-

PGC YTD Avg Days on Market 2011 = 98 days

The year-to-date average close price to original list price ratio in the metro DC area was 94.2 percent (as of July 31st) with five consecutive months above 94 percent. In Prince George’s County, the year-to-date average is 89.3 percent and it’s had five consecutive months below 90 percent.

Another troubling aspect of the Prince George’s County market is its share of distressed sales (short sales and bank-owned properties). The ratio is trending down but it is still strikingly high. Roughly 23 percent of metro DC’s sales in July 2011 were distressed. About 57 percent of Prince George’s sales were distressed in July. Through the end of July, the 2011 average share of distressed sales in the metro area was 32 percent; it was 64 percent in Prince George’s County. Further, for the last two consecutive months the metro DC share was less than 25 percent; it was above 55 percent in Prince George’s County since May 2010.

By contrast, the other component jurisdictions and realtor associations in the metro DC area have all seen year-to-date median sales price increases in 2011 compared to 2010; the 2011 average days on market is below 80 days elsewhere in the region; the 2011 average close price to original list price ratio exceeds 93 percent everywhere but Prince George’s County; and the 2011 average share of distressed sales exclusive of Prince George’s ranges from 15 percent in the District of Columbia to 43 percent in the Prince William realtor association (PWAR).

For more detail, please see Metro Dc Housing Analysis 2011 07

Western Loudoun County Analysis: 2011 07

Posted: August 8, 2011 Filed under: Western Loudoun County Analysis | Tags: 2011, Average Close Price, days on market, Inventory, Loudoun, Market Trends, Median Sales Price, Price Changes, Pricing, Sales, western loudoun Leave a commentRecord Breaking Home Sales in July

According to the Metropolitan Regional Information Service (MRIS), the 67 home sales during July in the Western Loudoun area (consisting of Middleburg, Purcellville, Round Hill, Hamilton, Lovettsville and Waterford) increased 12 percent from June and reached its highest monthly level in at least four years. In fact, 2011 sales through July have outpaced total sales from January to July 2010 by 11 percent and beat the 2009 total through July by 23 percent. In a typical year, the highest monthly sales in Western Loudoun are posted in June or July so we can expect monthly sales to decline through the rest of the year.

By contrast, home sales declined from 574 units in June to 452 in July for the entire county (-23 percent).

The table below lists July sales by area. Purcellville regained its dominance by posting 39 percent of the total sales last month in Western Loudoun in addition to a 53 percent increase over June and an 86 percent increase over last July. Middleburg’s five sales in July represented a 400 percent increase over the one sale it had last July.

Although Western Loudoun posted stellar home sales in July, the median sales price took a huge hit. The median in both May and June was $435,000 in Western Loudoun. In July, it dropped 23 percent and $100,000 to $335,000. A whopping 51 percent of the increased number of sales in July were priced between $200,000 and $399,999 and only one home sold at a price higher than $1,000,000. Compare that to June when only 33 percent of sales were priced in the $200,000 to $399,999 range and 3 homes sold for more than $1,000,000. The good news though is that the year-to-date median sales price only decreased $5,000 from June to $410,000 which is equal to the 2010 median. The median sales price more than doubled last month in Middleburg, the only Western Loudoun area to see a month-over-month increase. Although not shown above and interestingly, the year-to-date median sales price in Waterford is $749,000 while it is only $550,000 in Middleburg.

Typically, homes in Western Loudoun are on the market longer than those in other areas of the county. For example, the average days on market in Western Loudoun during July 2011 amounted to 87 days, down from a revised 114 days in June and 60 days last July. By contrast, homes sold in only 41 days on average in Eastern Loudoun during July while the average was just 61 days in Leesburg. Since January 2010, the lowest average in Western Loudoun occurred last July (60 days) and the highest was in January 2010 (235 days).

Thirty homes (45 percent) sold in 30 days or less last month with an average close price of $350,480. Compare that to 52 percent across the entire county with an average close price of $401,527. There were three closings in Western Loudoun during July that took longer than a year to sell; the average close price of these units was $786,000. They combined with three others in Eastern Loudoun and Leesburg to bring the county total to six units during July that were on the market over a year; the average close price of all six was $713,750.

Like sales totals, the days on market indicator varies significantly by individual market. Lovettsville had the lowest July average with 43 days while the average in Middleburg was 208 days (one of the five was on the market 508 days).

The average close price to original list price ratio may reflect two things: sellers’ ability to accurately price their homes to match market conditions and/or their willingness to negotiate price. The ratio decreased in July to 91.9 percent from a revised 94.9 percent in June. Western Loudoun normally has the lowest close price to original list price ratio; it was 96.5 percent in Eastern Loudoun and 94.8 percent in Leesburg last month. Here in the west, the lowest ratio occurred in Hamilton (86.0 percent) and the highest was found in Waterford (94.2 percent).

In June, eight townhouses sold in Western Loudoun at an average price of $209,113. The average price for the 59 detached homes sold last month was $426,211. Condominiums are not a factor in Western Loudoun.

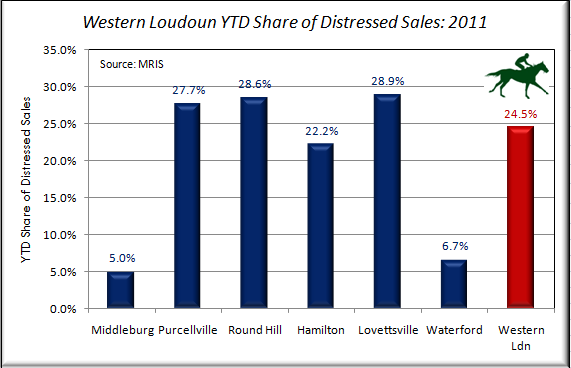

The year-to-date share of short sales and foreclosures (24.6 percent distressed sales) in 2011 is the result of five consecutive months of declines from February to June. Compare that 24.6 percent to this time last year when the year-to-date share of distressed sales was 34.9 percent. Middleburg and Waterford have had only one distressed sale each so far this year explaining their low shares while the percentage exceeds 23 percent in the other local areas.

Even though the month’s supply of inventory reached its lowest point this year in July at 5.8 months, it is considerably higher in Western Loudoun than elsewhere in the county. Note that the months of supply in Eastern Loudoun was 2.7 months during July and it was 4.0 months in Leesburg. West of Leesburg, Waterford had the highest available inventory at 18.5 months and Round Hill had the lowest at 4.1 months of supply in July.

Spotlight on Round Hill

Through the end of July, 69 homes sold in Round Hill this year representing 21 percent of the Western Loudoun total. That’s an average of about 10 homes per month which matches the 2010 pace. The year-to-date median sales price was $370,000 at the end of July, -1 percent from the 2010 median of $373,000. About 51 percent of Round Hill’s 2011 sales were priced between $200,000 and $399,999, another 25 percent were in the $400,000 to $599,999 range. The average days on market in Round Hill was 115 days in June; it declined to 86 days in July. The close price to original list price ratio was 93.9 percent in July, a far cry from 64.3 percent in February. So far this year, 30 percent of Round Hill sales were distressed (one of the highest ratios in Western Loudoun) but the month’s supply of inventory, at only 4.1 months, is the lowest in the west and suggests it may be on the verge of being undersupplied.

Western Loudoun had a shocking number of sales in July, posting the highest monthly sales figure in years, something the county as a whole cannot claim. However, the dramatic decline in the median sales price is troubling and hopefully a one-month anomoly.

Rosemary deButts, Realtor, is associated with Atoka Properties located in historic Purcellville. She has the Short Sales and Foreclosure Resource certification and is a Member, Institute of Residential Marketing. Rosemary earned her degree in Economics from Randolph-Macon Woman’s College and her MBA from Old Dominion University. For more information on the Western Loudoun housing market and guidance in buying or selling a home, contact Rosemary today (rosemary@atokaproperties.com; 540-454-6792; http://www.housinganalyst.net).

Old Dominion Valley Subdivision Analysis

Posted: August 2, 2011 Filed under: Subdivision Analysis | Tags: 2011, Average Close Price, days on market, Loudoun, Market Trends, Median Sales Price, Old Dominion Valley, Pending Listings, Price Changes, Seller Subsidies, Short Sales, Villages of Purcellville, western loudoun Leave a commentSignificant Improvement in 2011

In all of 2010, only two homes sold in Purcellville’s Old Dominion Valley neighborhood. So far in 2011, four homes have changed hands. Even more important though is that the year-to-date median sales price in Old Dominion Valley is $428,000, $48,000 and 13 percent higher than the 2010 median of $380,000. Last year, list prices were reduced an average of 3.5 percent ($14,500) before receiving a contract; this year the average price decrease is only $2,275 or .5 percent (an 84 percent drop from last year). Average seller contributions have declined 16 percent this year to $6,750. The average time to sell dropped from 113 days in 2010 to 39 days in 2011. One of the two sales last year was a bank-owned property and the other was a standard (non-distressed) sale.

There were only two active listings in Old Dominion Valley as of August 2nd. The current average list price is very low, only $390,300. That’s because one of the active listings is a bank-owned property offered at $370,700. The remaining standard active listing has an asking price of $409,900. They have been on the market an average of 93 days.

The one pending sale is a short sale that had a contract in just fourteen days at a list price of $419,900.

If now is the time for you to move, I would be honored to help you sell your home and/or answer any questions you may have about the real estate market here in Loudoun County.

Look for my new column in The Purcellville Gazette: “The Dirt on the Market”

Western Loudoun County Analysis: 2011 06

Posted: July 11, 2011 Filed under: Western Loudoun County Analysis | Tags: 2011, Average Close Price, days on market, Foreclosures, Inventory, Loudoun, Market Trends, Median Sales Price, Price Changes, Pricing, Sales, Short Sales, western loudoun Leave a comment

Western Loudoun Sales and Prices Strong in June

According to the Metropolitan Regional Information Service (MRIS) and as of June 30, 2011, the year-to-date preliminary existing home sales (257 units) in the Western Loudoun area (consisting of Middleburg, Purcellville, Round Hill, Hamilton, Lovettsville and Waterford) exceeded the year-to-date total at this time in 2010 by four units and by 43 units over 2009. The highest monthly sales are typically recorded in June in this highly cyclical industry and June did not disappoint in Western Loudoun. 59 homes closed during June in Western Loudoun, up from a revised 46 in May and 57 during June 2010. This was the highest monthly total since at least January 2009. For the sake of comparison, the year-to-date sales totals in all of Loudoun County are still the lowest in at least six years.

The table below lists June sales by area. Sales in Round Hill outpaced Purcellville for the first time since March of 2009, doubling the number of sales there during May. Lovettsville posted a huge monthly gain, jumping from 3 sales in May to 10 in June.

As shown above, the June median sales price in the Western Loudoun area increased 1 percent to $440,000 from $435,000 in May. At this time last year, the median was only $415,000 (+6 percent). June’s increase boosted the year-to-date median to $415,000, reflecting the highest annual median since 2007. (The year-to-date median sales price for all of Loudoun County is also the highest in four years at $375,500.) Four homes closed in Waterford in June that ranged in price from $749,000 to $1,065,000 resulting in a monthly median sales price of $935,000 and a year-to-date median of$775,000 – clearly the area leader so far this year.

Year-to-date, 37 percent of the sales in Western Loudoun were priced between $200,000 and $399,000, matching the share in this price range during 2010. However, the percentage of homes sold at prices between $600,000 and $799,999 was 16 percent in 2011; it was only 13 percent in 2010.

Typically, homes in Western Loudoun are on the market longer than those in other areas of the county. For example, the average days on market in Western Loudoun during June 2011 amounted to 115 days, down from a revised 163 days in May and 107 days last June. By contrast, homes sold in only 41 days on average in Eastern Loudoun during June while the average was just 57 days in Leesburg. Since January 2010, the lowest average in Western Loudoun occurred last July (60 days) and the highest was in January 2010 (235 days). While 42 percent of the June closings were under contract within 30 days of listing, 10 percent took a year or longer to sell.

Like sales totals, the days on market indicator varies significantly by individual market. Middleburg and Purcellville tied for the lowest average with 51 days while the June average in Waterford was 248 days.

The average close price to original list price ratio may reflect two things: sellers’ ability to accurately price their homes to match market conditions and/or their willingness to negotiate price. The ratio increased significantly in June to 94.4 percent from a revised 86.6 percent in May. Western Loudoun normally has the lowest close price to original list price ratio; it was 97.0 percent in Eastern Loudoun and 96.8 percent in Leesburg last month. Here in the west, the lowest ratio occurred in Waterford (86.9 percent) and the highest was found in Hamilton (98.4 percent).

In June, four townhouses sold in Western Loudoun at an average price of $235,000. The average price for the 55 detached homes sold last month was $511,980. Condominiums are not a factor in Western Loudoun.

The year-to-date share of short sales and foreclosures (24.5 percent distressed sales) in 2011 is the product of two months below 19 percent (April and June). Compare that to this time last year when theyear-to-date share of distressed sales was 34.1 percent. Middleburg and Waterford have had only one distressed sale each so far this year explaining their low shares while the percentage exceeds 22 percent in the other local areas.

The month’s supply of inventory is also considerably higher in Western Loudoun than elsewhere in the county. As of July 7th, there was a 6.4 month’s supply of available inventory in Western Loudoun. While it is high, there was improvement; the month’s supply of inventory exceeded 8 months from January through May. Compare 6.4 months of supply to 2.1 months in Eastern Loudoun during June and 2.9 months in Leesburg. Middleburg had the highest available inventory at 21 months and Round Hill had the lowest at 3.1 months in June.

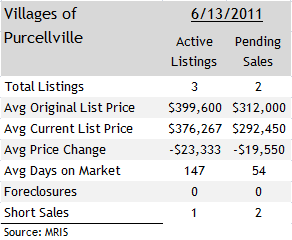

Spotlight on Purcellville

Purcellville is having a good year compared to its recent history. It typically has the highest sales volume in Western Loudoun and has posted 101 sales so far this year. By comparison, at the end of June 2010, Purcellville had only 95 total sales and at the same time in 2009, sales only totaled 82 units. Close prices in Purcellville ranged from $139,500 to $2,250,000 this year. Of the 101 2011 sales, 46 percent were priced between $400,000 and $599,000 and 30 percent were priced between $200,000 and $399,999. Four homes sold at prices exceeding $1,000,000 (three more than in Middleburg!). The median sales price in 2011 was $425,000 as of June 30th, +6 percent over the 2010 annual median. The June median was $458,000, 4 percent higher than the May median and 12 percent higher than the June 2010 median. Finally, about 28 percent of the sold homes this year were distressed.

Western Loudoun is having a banner year compared to Loudoun County as a whole. 2011 Sales have not suffered here in comparison to 2010 sales as they were expected to do in the absence of the First Time Buyer’s Credit this year. If historical trends hold though, sales will decline from 59 units beginning in July through the rest of the year. However, I predict we will end the year ahead of 2010 totals. Additionally, median sales prices have increased 7.5 percent since January, clearly indicating a healthy market.

Rosemary deButts, Realtor, has lived in Purcellville for almost twenty years and is associated with Atoka Properties, currently located near Bloom. She has the Short Sales and Foreclosure Resource certification and is a Member,

Institute of Residential Marketing. Rosemary earned her degree in Economics from Randolph-Macon Woman’s College and her MBA from Old Dominion University. She and her husband, Jimmy (a lifelong resident of Western Loudoun), have seven children, six of whom are Loudoun Valley High School alums. For more information on the Western Loudoun housing market and guidance in buying or selling a home, contact Rosemary today (rosemary@atokaproperties.com; 540-454-6792; http://www.housinganalyst.net).